Over 30 years of anarchist writing from Ireland listed under hundreds of topics

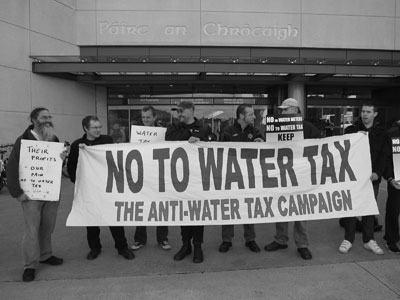

Household & Water Tax Can’t Pay, Won’t Pay

The government has made it clear that it is determined to press ahead with its attempts to impose not one but two new taxes on us. Minister for the Environment Phil Hogan is preparing to bring plans to government for a household tax, probably starting at €100 per year, from 1st January. This tax will be added to by a water tax, expected to be introduced within the next couple of years.

The government has made it clear that it is determined to press ahead with its attempts to impose not one but two new taxes on us. Minister for the Environment Phil Hogan is preparing to bring plans to government for a household tax, probably starting at €100 per year, from 1st January. This tax will be added to by a water tax, expected to be introduced within the next couple of years.

Both these taxes are simply another attempt by government to raid the pockets of ordinary workers and families to pay for the financial crisis. Already we’ve suffered pay cuts, increased taxes, social welfare cuts, the imposition of the Universal Social Charge and massive cuts social services such as education and health that we depend upon.

Meanwhile the wealthy continue to coin it. In 2009 the number of people in Ireland with investable assets over $1 million increased by 10% to 18,100. The number of people with investable assets over $30 million increased by 18 to 181. Figures released by the Central Bank in May showed that there is currently about €120 billion held in hard currency and bank deposits in the Irish economy. The problem, of course, is that this wealth is held by a tiny number of hands and the government, just like its predecessor, is unwilling to make the wealthy pay their share of tax.

Instead they continue to come up with ways of taking money from us. They see us as the soft touch. There is no justifiable economic reason for imposing a new tax on us. The wealthy can and should be made to pay, we have already taken far more than our ‘share’ of the ‘pain’.

Power

But the government can only impose these taxes on us if we let them. Most of the taxes we are forced to pay is taken from our pay packets before we receive them or are imposed on the goods and services we have to buy. But household and water taxes will require us to write a cheque or make a payment via our credit cards. That gives us a lot of power as it means that we can simply refuse to pay, which is what each of us, as an individual, has to do. Simply we have to say NO, they’ve taken enough from us, and we’re not going to pay any more.

But while step one in defeating this tax is each of us making the individual decision not to pay, these taxes can only be defeated by collective action. Just as we did during the last attempt to impose water taxes in the 1990s, we need to organise in our communities and build strong campaigning groups.

Community campaigns

Non-payment campaigns can be built in every single community. The first task faced will be to talk to and encourage all members of the community to join the non-payment campaign. Then we need to organise to support and encourage each other, and to defend each other when the government attempts to attack us through legal or political action. This will require the active participation of as many people as possible. Politicians, community leaders or trade union leaders cannot do it for us. The strongest campaigns will be those that involve large numbers of ‘ordinary’ people.

That means people like you. You don’t need to have any previous experience of organising campaigns to get involved, you just need to have a willingness to work alongside your neighbours and friends to take the simple steps of helping to build a campaign in your area. A No To Water Tax Campaign has already been established and will be building in every community over the coming months. Members of the Workers Solidarity Movement will be active in helping to establish this campaign. We hope that you too will get involved. Please get in touch and we will support or help in any way we can to help build a local campaign in your area.

_0.jpg)

This article is from Workers Solidarity 122 July 2011

Read more articles online

Download the PDF file